If you’re a UK advertiser or content creator looking to crack the Japan market via Snapchat in 2025, this one’s for you. Snapchat’s buzzing in Japan, but the ad rates, formats, and local nuances can be tricky to navigate from across the pond. As of June 2025, we’ve gathered the lowdown on Japan’s Snapchat ad pricing across all categories – tailored for the UK market to help you plan your spend wisely and get bang for your buck.

📢 Marketing Context for UK Advertisers Eyeing Japan on Snapchat

Japan’s Snapchat scene is unique. Unlike in the UK, where Instagram and TikTok hog the limelight, Snapchat in Japan has carved out a niche among younger users who love its AR filters and fleeting Stories. For UK brands like ASOS or Gymshark wanting to dip toes in Japan, Snapchat offers a fresh channel to engage Gen Z and Millennials with immersive, interactive content.

Payments? It’s all about JPY but for UK clients, expect your agency or platform partner to invoice in GBP or USD, with payment via international bank transfers or credit cards. Keep tax and compliance in mind—Japan’s advertising laws are strict on claims and user privacy, akin to GDPR in the UK but with its own quirks. Partnering with local Japanese agencies or influencers can smooth out legal and cultural bumps.

📊 2025 Japan Snapchat Ad Rates by Category

Here’s a snapshot of Snapchat ad rates in Japan as of June 2025. Rates are approximate and reflect typical Cost Per Mille (CPM) or Cost Per Swipe (CPS) depending on the format:

| Category | Format | CPM (JPY) | CPM (GBP approx) | Notes |

|---|---|---|---|---|

| Fashion & Beauty | Snap Ads | ¥1,200 | £7.50 | High engagement, popular with youth |

| Gaming & Apps | Story Ads | ¥1,000 | £6.25 | Strong click-through rates |

| Food & Beverage | AR Lenses | ¥1,500 | £9.40 | Premium interactive ads, higher CPM |

| Automotive | Snap Ads | ¥800 | £5.00 | Niche but growing interest |

| Entertainment | Snap Ads | ¥1,100 | £6.90 | Good reach for music and events |

| Travel & Tourism | Story Ads | ¥900 | £5.60 | Seasonal spikes, especially during holidays |

| Finance & Insurance | Snap Ads | ¥1,300 | £8.15 | Regulatory-heavy, requires careful copy |

Exchange rate used: 1 GBP ≈ 160 JPY

How Do These Rates Compare to UK Snapchat Ads?

In the UK, Snapchat CPMs tend to range from £5 to £10, depending on targeting and ad format. Japan’s rates are pretty comparable, with a slight premium on interactive AR lenses and finance sectors due to regulatory and tech demand.

💡 Practical Tips for UK Advertisers Working with Japan Snapchat Ads

-

Localise Your Content

Japanese Snapchat users expect culturally tuned content. It’s not just about translation; it’s about adapting slang, visuals, and humour. UK brands should collaborate with local creators like @TokyoTrendsetters or agencies such as Dentsu for authentic campaigns. -

Choose the Right Payment Method Early

Confirm payment terms with your media partner. Avoid surprises with foreign exchange fees or delayed payments. Using GBP billing with platforms like BaoLiba can streamline the process. -

Leverage AR Lenses for Maximum Impact

AR filters are huge in Japan. UK brands in cosmetics or gaming sectors should invest here despite higher CPMs – the engagement and shareability pay off. -

Stay GDPR and Japan Privacy Act Compliant

Cross-border data flows are sensitive. Work with legal teams to ensure user consent and ad targeting respect both UK and Japanese laws.

📊 People Also Ask

What is the average Snapchat ad rate in Japan for 2025?

As of June 2025, Snapchat ad CPMs in Japan range from roughly £5 to £9.40 depending on the category and ad format, with AR lenses being the priciest.

How can UK advertisers pay for Snapchat ads in Japan?

Most UK advertisers pay in GBP via international bank transfer or credit card through their local agencies or media platforms, which then handle JPY payments to Snapchat.

Are Snapchat ads effective for UK brands targeting Japan?

Yes, especially for youth-focused brands in fashion, gaming, and entertainment. Snapchat’s AR features and Stories format resonate well with Japanese Gen Z audiences.

❗ Risks and Considerations

Japan’s ad market is nuanced. Overly aggressive or poorly localised ads can backfire. Also, fluctuating exchange rates and payment delays can impact budgets. Always test small before scaling, and keep legal counsel handy.

Final Thoughts

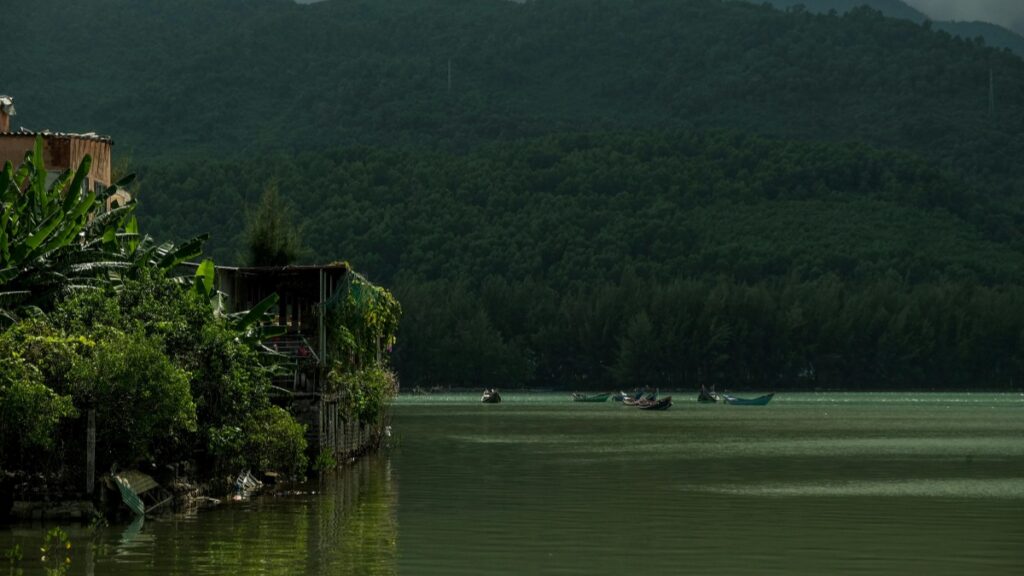

Navigating Japan’s Snapchat ad landscape in 2025 from the UK might look like a jungle, but with the right knowledge and local partnerships, it’s a goldmine for reaching young, engaged audiences. Bookmark this Japan Snapchat ad rates table and keep an eye on evolving trends.

BaoLiba will continue updating the United Kingdom influencer marketing scene, so stay tuned for more insider tips and fresh data. Let’s get those campaigns popping across borders!